Over three years after the pandemic began, central business districts (CBDs) are grappling with complex, intertwined challenges related to business closures, reduced foot traffic, and, in some areas, widespread office vacancies. It’s clear that downtown revitalization efforts must prioritize the immediate concerns of economic recovery while also anticipating the long-term effects of the pandemic on urban life — many of which will likely unfold over decades.

With that in mind, we begin this report by providing an overview of the current state of CBDs, pulled from the perspectives of 26,000 urbanites in 53 cities across six global regions. The remaining sections of the study are devoted to three different downtown personas: residents (people who live in their CBDs), employees (people who are employed at a business or organization in their CBD), and local visitors (people who neither live nor work in their CBD but live in the city proper). By appealing to the broad mix of people who live, work in, and visit their CBDs, urban centers can enter a new age of vitality.

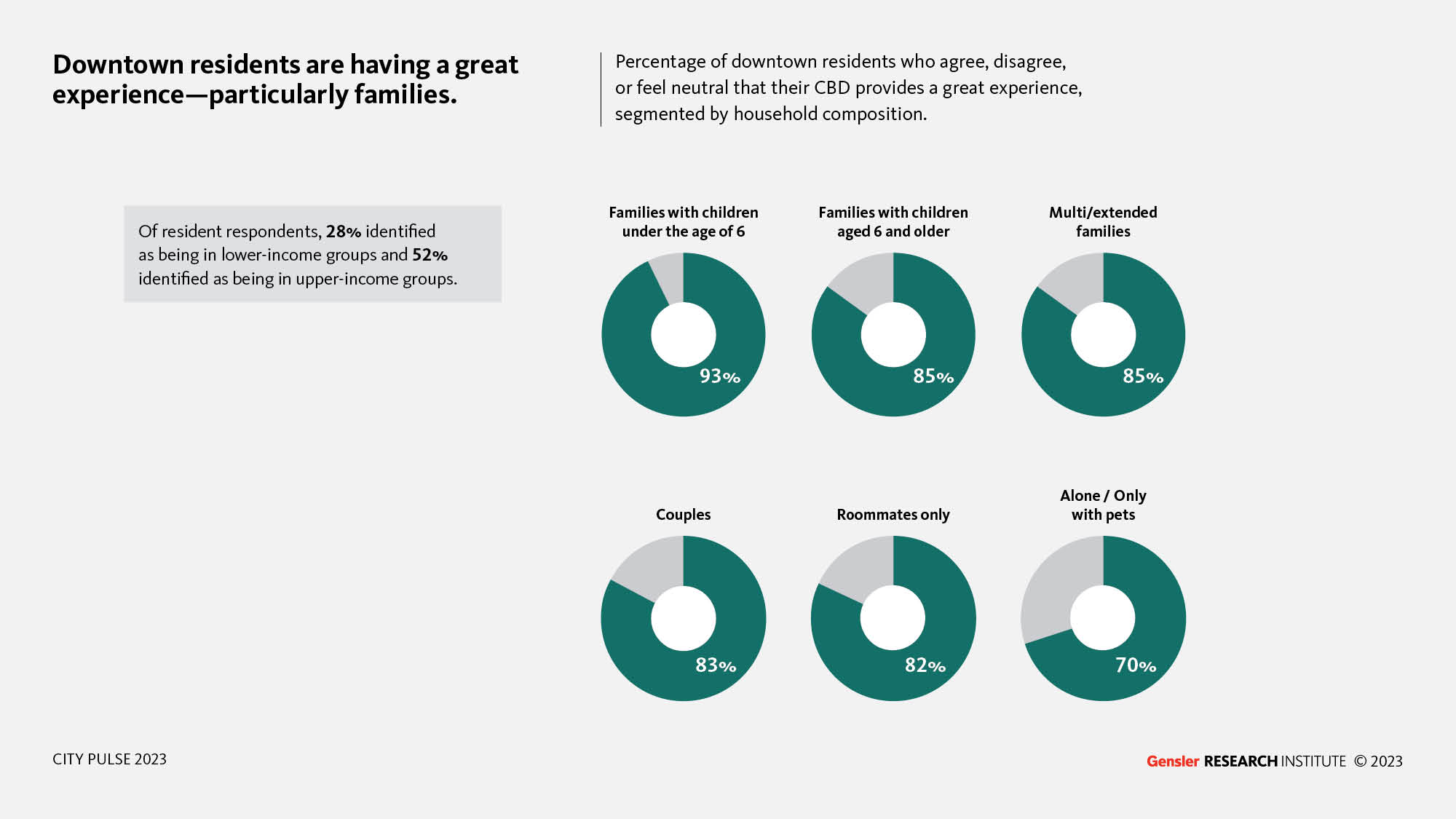

Of all downtown residents, families are having the best experience.

The majority of downtown residents (people who live in CBDs) agree that their CBD provides a great experience — the highest percentage of any CBD persona. When looking at the data by household composition, we found that respondents who live in households that include family members are more satisfied with their CBD experience than those who live with partners, roommates, or alone. Families with children are having the best experience of all surveyed household typologies.

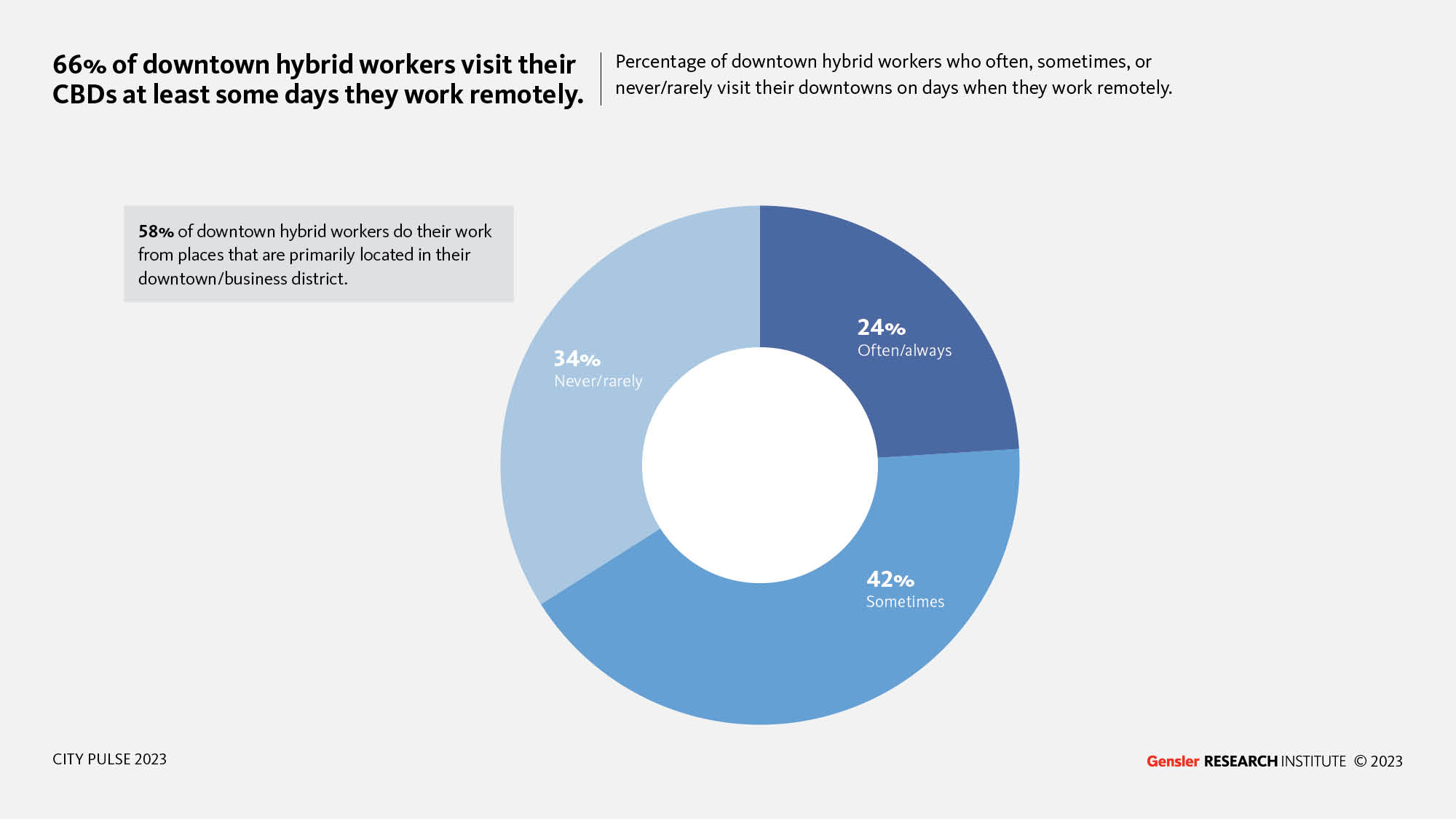

Hybrid workers haven’t abandoned their CBDs.

Much of the decline of central business districts — and city economies a whole — has been attributed to the rise of the hybrid workforce. However, as urban centers emerge from the immediate aftermath of the pandemic, hybrid workers have not abandoned or lost enthusiasm for their downtowns. 66% of hybrid CBD-based workers visit their CBDs at least some of the days that they work remotely. And 58% of downtown hybrid employees work from cafes, coworking spaces, and other third places within their CBDs.

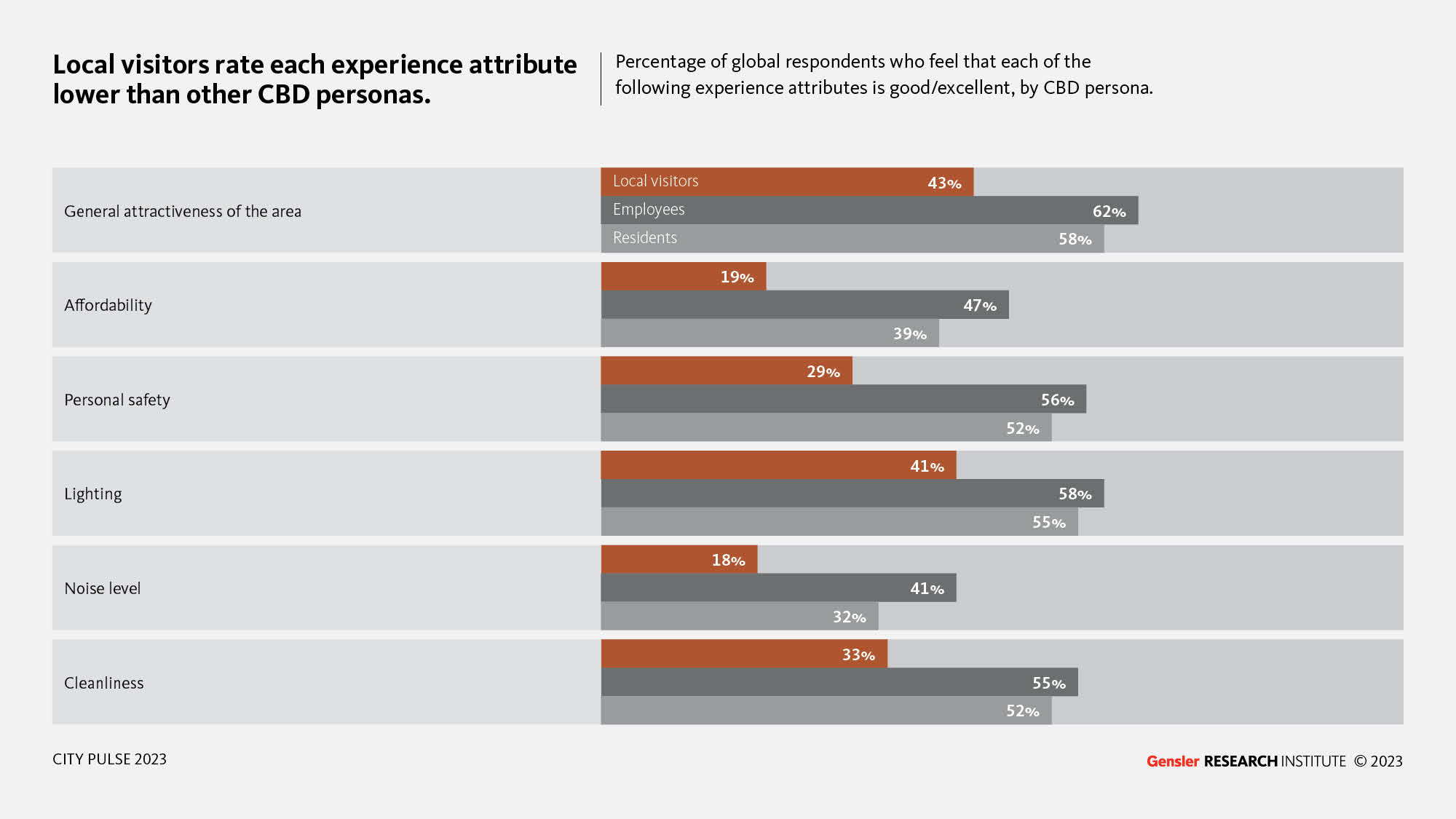

Local visitors to downtowns rate their CBDs lower than residents or employees; CBDs need to close the experience gap to reach this untapped market.

Local visitors (respondents who neither live nor work in their CBDs but live in the city proper) rank their downtowns lower than other CBD personas on each experience attribute that Gensler surveyed. They are also the least likely of any persona to feel that their CBD is iconic, grand, or blends in with the surrounding neighborhoods, and the least likely to feel that their downtown is social media-worthy. Only one in five local visitors frequent their CBD at least once a week or more, and the rest go less often. Attracting a greater number of local visitors downtown more frequently will help ensure and sustain the economic recovery of CBDs.

City Pulse 2023 Methodology

Data for the Gensler City Pulse Future of the Central Business District (CBD) Study was gathered via an anonymous, panel-based survey of 26,007 total urban residents in 53 cities across the world. The survey was conducted online from May 1 to June 18, 2023. Survey respondents were recruited by Qualtrics (a third-party research firm). Respondents were required to live within the city administrative boundaries, with the exception of Los Angeles — where residents were required to live within the county administrative boundaries. Respondents were demographically diverse across gender, age (18+), race/ethnicity (in U.S. cities only), income, employment, and education levels. Quotas around demographic and geographic characteristics were carefully monitored and enforced during fielding to ensure balanced distributions per city.

Download the full Gensler City Pulse 2023 Future of Central Business Districts report to learn how CBDs can ensure that residents, employees, and local visitors stay engaged with downtown cores.